If you’re like most dental offices, you get calls from credit card processors promising great savings that never materialize. You may have switched a few times, chasing the lowest rates, only to find that you’re still paying more than you have to.

Accepting credit cards at your dental practice can improve cash flow and reduce staff time spent chasing down late invoices. However, many practices aren’t familiar with the details of processing, resulting in frustration over high fees or a system that doesn’t suit your needs.

Credit card processing is complex at the best of times, but for dental practices, it comes with extra variables, such as HIPAA compliance, compatibility with practice management systems, storing cards on file, and acceptance of Health Savings Account (HSA) cards, Flexible Spending Account (FSA) cards, and CareCredit cards.

But you can cut through the sales spin to find the right solution for your practice, at the right price, once and for all.

Components of Cost

If you’re asking processors what their rates are, you’re setting yourself up to overpay.

Finding the lowest-cost solution isn’t about the lowest rates, which only refer to one part of the cost picture and can be easily manipulated. It’s about securing the lowest markup over wholesale. To do that, you’ll need to know about the components of cost and how they fit together.

Even though dentists often have special requirements for equipment or types of cards accepted, the basic structure of processing is the same. The total price that you’ll pay comprises three separate pieces: interchange, assessments, and processor’s markup.

Interchange is the largest component of cost. Unfortunately, it is non-negotiable. The card brands (Visa, Mastercard, Discover, American Express) set the interchange rates, which are the same for every processor.

When you accept a credit card at your practice, it will be routed to a particular interchange category and charged according to the rate for that category. Interchange fees go to the banks that issue credit cards to your customers. Visa and Mastercard both publish their interchange tables, while Discover and American Express do not.

Assessments are a smaller component of cost, but they also are non-negotiable. They’re set by the card brands and the same for every processor as well, but the fees go to the card brands themselves. Assessments aren’t published on the card brands’ sites, but CardFellow maintains a list of current assessment charges.

The processor’s markup is the only component of cost that you can negotiate. This is what the processor charges on top of the non-negotiable fees imposed by the banks and credit card brands. It includes any fees that aren’t interchange or assessments, including per-transaction fees, percentage fees, monthly fees, and statement fees.

Since interchange and assessments are non-negotiable, they’re not where you want to focus your time. If your goal is to secure the most competitive pricing, you’ll need to secure the lowest possible processor markup.

Think of interchange and assessments as the “wholesale” cost of credit card processing. The closer you pay to wholesale, the better. A crucial component to paying the lowest markup over wholesale is the pricing model.

Pricing Models

Signing up with a processor that charges via an opaque pricing model is one of the most common ways that practices overpay. If you’re looking to pay as little as possible for processing, you’ll need to ensure you’re on a transparent pricing model with a competitive markup. In credit card processing, there are two main pricing models: tiered and interchange plus.

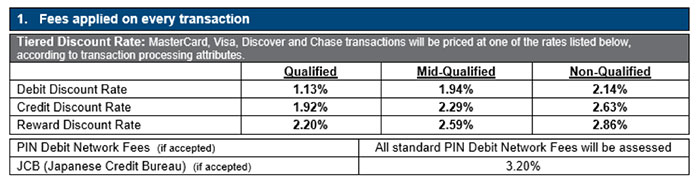

Pricing that includes “qualified” and “non-qualified” rates indicates a tiered pricing model. Tiered pricing is an opaque and expensive option that your practice is better off avoiding.

With tiered pricing, your processor will create different tiers to charge you. While processors can create as many tiers as they’d like, it’s common to see three: qualified, mid-qualified, and non-qualified. Processors often show you only the best “qualified” rate to make you think it’s a good deal. However, once you sign up, the processor will route your transactions to the tier of its choice, not necessarily to the teaser rate tier it showed you during the sales pitch.

Additionally, processors can change the qualifications at any time, effectively enabling them to raise your pricing as often as they’d like. The result is processing costs that are expensive and difficult to predict.

The figure illustrates a tiered interchange as shown on a merchant services application. This particular processor uses a nine-tier model, with qualified, mid-qualified, and non-qualified rates for three different categories of cards: debit, credit, and rewards cards. If you accept a debit card, it’s up to your processor whether you’ll pay a 1.13%, 1.94%, or 2.14% rate to accept that card.

Even though 1.13% looks like a low rate, remember that you won’t necessarily pay that amount. The processor doesn’t have to route your transactions to the “qualified debit” category. Even if the processor starts off charging you the qualified rates, it can (and often does) change it to the higher mid-qualified or non-qualified rates. Other fees also apply.

It’s important to note that “qualified” and “non-qualified” cards are not determined by Visa or Mastercard, no matter what a processor might say. That designation is completely invented by individual processors and can be avoided completely by utilizing the more transparent interchange plus pricing.

Interchange Plus

A more transparent pricing model, interchange plus works by passing the costs of interchange and assessments to you and then applying a small, separate markup. There are no “qualified” and “non-qualified” rates, and your costs are not bundled into tiers.

The benefit to interchange plus is that you’ll be able to pay the actual costs set by the credit card companies, rather than an invented “qualified” or “non-qualified” rate that benefits the processor, not you. With a competitive interchange plus solution, your processor doesn’t manipulate your transactions according to arbitrary tiers.

Interchange plus sets the stage for the lowest costs for processing, but it’s not a guarantee. You’ll still need to secure a low processor markup and ensure that you work with a processor that passes interchange and assessments to you at true cost, with no padding.

When considering interchange plus processors, you can ask directly if interchange will be passed at cost. Also, don’t be afraid to ask for a lifetime rate lock on the processor’s markup to ensure that your rates don’t creep up over time.

Cards on File

Some practices prefer to keep their patients’ cards on file for quick checkout at the end of an appointment, but wonder if that’s HIPAA compliant. As long as you’re taking the proper steps to secure cardholder data, it’s perfectly fine to keep cards on file.

However, that doesn’t mean you can just photocopy credit cards or maintain a spreadsheet of card numbers. Instead, you’ll need a secure option that meets Payment Card Industry Data Security Standards (PCI-DSS) regulations.

Fortunately, almost all processors offer a secure “card vault” where you can store card information safely and charge that card easily in the future. If you want to keep cards on file, you can ask your processor about setting up a secure card vault.

Keep in mind that stored cards will be processed as “card-not-present” transactions, which may incur higher costs than “card-present” transactions. You’ll also want to make sure that your patient is aware that you’re charging the card before you run it. Otherwise, you may receive a chargeback, or patient-initiated reversal of the payment. If you receive too many chargebacks, your processor can close your account.

You can dispute chargebacks and present evidence that the charge is legitimate, but that will take staff time and may not always be successful.

Fortunately, dental practices typically receive fewer chargebacks than other types of businesses. You can help keep your chargebacks low by confirming with your patients that they would like to use the card you have on file.

HSA/FSA/CareCredit

Many practices also wonder about accepting HSA cards, FSA cards, and healthcare-specific cards such as CareCredit. Accepting such cards is a matter of ensuring that you’re correctly coded with the proper merchant category code (MCC).

When a business opens a merchant account for credit card processing, it is assigned a merchant category code. Certain cards such as HSA and FSA cards can only be used at locations with particular MCCs.

There are several healthcare-specific MCCs, including doctors, dentists and orthodontists, hospitals, dental and medical laboratories, and general health practitioners. As long as you’re set up with a healthcare MCC, you’ll be able to accept healthcare-specific cards.

However, it’s important to note that HSA and FSA and CareCredit cards may have daily purchase limits, just like any other type of card. If a patient doesn’t have enough funds on the card or has hit a purchase limit, the card will be declined. You can advise these patients to contact their HSA or FSA administrator if they have a problem with a declined card.

HIPAA Compliance and Credit Card Processing

Staying compliant with HIPAA regulations can feel like a neverending battle. Fortunately, in credit card processing, accepting cards typically falls outside of the HIPAA scope.

When it comes to HIPAA, there are two parties: covered entities and business associates. Your practice is the covered entity, while third-party vendors that provide services to you are business associates. An example of a business associate would be an IT company that performs computer services for your practice.

Processors, on the other hand, are not considered business associates, even though they do offer a service to you, because they’re also enabling payment for a customer. The Health and Human Services website explains that a credit card processor is considered to be performing “normal banking functions” for customers and is not performing on behalf of your practice, the covered entity.

If a processor only performs payment functions for your practice and doesn’t have access to sensitive patient files, the processor is not a business associate for the purposes of HIPAA compliance. But if the processor performs services for you that go beyond payment functions, it will be considered a business associate.

If your payment processor performs additional functions beyond enabling payments from customers, then HIPAA compliance may come into play. Additional functions could include services such as invoicing and billing. Those additional functions are beyond the “normal banking” scope and in turn tip the scales to the processor working on your behalf and not just enabling transactions between your practice and cardholders.

That’s not to say you can’t still work with such companies and maintain HIPAA compliance, but you will need a business agreement with those vendors.

If you’re like many practices, you work with a payment processor that isn’t considered a business associate. While you won’t need to obtain a business agreement with those processors, it’s important that you keep your patients’ personal health information private.

Be sure to train your staff not to include the details of a patient’s visit or treatment in any comments or notes fields in online payment forms. You should not provide processors with explanations of benefits, notes about upcoming appointments, or details of the patient’s current visit. Such information is not necessary for the processor to complete a transaction between a patient cardholder and your office, so it should not be shared with the processor.

Credit Card Processing and Practice Management Systems

There are two options for accepting credit cards when you use a practice management system: integrated processing and non-integrated processing.

Integrated processing means that the transaction information will automatically post to your patient’s file. It requires less human input, but often comes with limitations on which processors you can use, which in turn costs you more.

Non-integrated processing means that you’ll be able to process cards, but will need to manually note that a patient has paid in your practice management system. You’ll use a countertop credit card machine, USB card reader, or secure online form to enter credit card details to accept a payment.

The credit card machine or web form doesn’t directly communicate with your practice management software, so once payment is made, you’ll mark it as paid in your patient’s file. This option requires a little more human input, but also saves you money, as you can choose from a greater selection of processors.

If you use (or plan to use) a practice management system and want to accept credit cards, you’ll first need to find out if the system offers a choice of processors or if it partners with one or two. Some systems, like Dentrix, only offer a couple of options.

Some practice management systems list credit card processor compatibility on their websites. If they don’t, you can ask directly.

If low cost is your priority, remember that you can set up non-integrated processing no matter what practice management system you use. You’ll simply accept cards outside of the system, which you will use for charting, patient history, appointments, and other non-payment functions.

Finding a Processor for Your Practice

So, how do you find the right processor once and for all?

The easiest way to find a competitive processor is to utilize a comparison service. These free tools provide you with instant, fully disclosed quotes from multiple processing companies without requiring you to share contact information with the processor.

Some services, like CardFellow, even come with extras like bi-annual statement audits from experts to ensure that you’re paying as little as possible for credit card processing.

When researching processors, remember these tips:

- Look for interchange plus pricing: Avoid offers with “qualified” and “non-qualified” rates, which indicate tiered pricing.

- Ask for a rate lock on the markup: Processors willing to “lock” your rate can save you money in the long run.

- Skip the cancellation fee: There are plenty of processors that don’t impose lengthy contracts with hefty cancellation fees. If the processor won’t wave a cancellation fee (in writing!), consider other options.

At the end of the day, there are hundreds of processors, all vying for your business. You can use that to your advantage to secure a processor that will offer you great pricing and great service.

Ms. Cunningham is the marketing manager for CardFellow.com, the leading resource for dental practices seeking the most competitive credit card processing. She can be reached at ecunningham@cardfellow.com.

Related Articles

Create Trust Through Great Customer Service

Get Value Out of Your Most Untapped Resource—Your Patients

How to Protect Your Dental Practice and Patients from a Data Breach