If you’re over the age of 40, you probably remember standing in a crowded Blockbuster frantically looking for a movie before all the new releases were rented for the night. Nobody meandering around the video store then had a clue that one day, this model would be antiquated and we would never again have to search for a physical copy of a movie

This is how disruption works. It comes on slow like a light snowfall, and might seem irrelevant at first. But in a very short period, it unleashes a blizzard of change that leaves only the innovators standing. Blockbuster never saw it coming. In 2008, then-CEO Jim Keyes said, “Neither RedBox nor Netflix are even on the radar screen in terms of competition.” He later declined to buy Netflix for a mere $50 million. Oops!

There are certainly disruptive technologies and services that will impact dentistry, and most of them will be great for both dentists and patients. But those who are committed to sticking with the old-school approach may find themselves crying in their beer next to Jim Keyes.

A Disruptive Approach to Retirement

Beyond technological advances, dental service providers will see other disruptions. In fact, one disruption will impact nearly every dentist (and dental employee) in the nation through their 401(k) plan.

For most dentists and/or office managers, the 401(k) is something to “set and forget.” The old guard providers (think Blockbuster), mainly insurance companies and payroll companies, like it this way. Why? Because for decades, the 401(k) has been a feeding trough for brokers, mutual fund companies, record-keepers, and a host of other unnecessary middlemen. The net result is often excessive and/or hidden fees that erode the accounts of the dentists and the staff who are saving their hard-earned money.

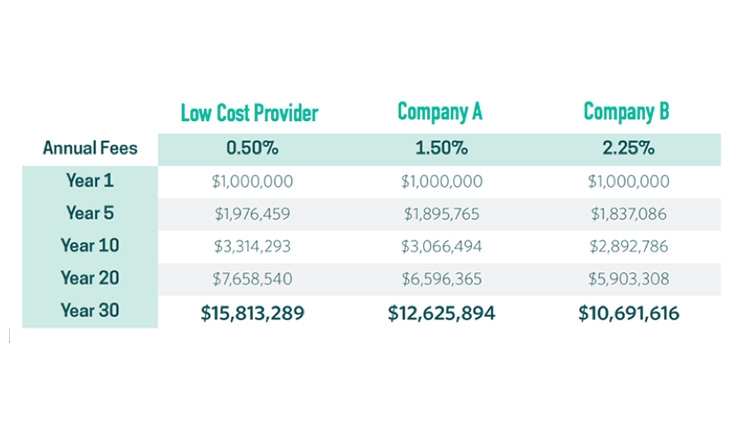

So just how much do fees impact the growth of a typical 401(k) plan? Take a dentist with $1 million in a plan with total contributions of $100,000 per year. Let’s assume annual performance of 7% over time. The figure above compares a low-cost provider and typical plans with fees of 1.5% to 2.25% annually. This plan will have dramatically different results depending on the choice of providers!

Reducing fees is quite easy, but first you must uncover how much you are really paying. Your fees will be buried deep in lengthy and often opaque fee disclosures that you should request from your provider’s customer service department. (Click here for a list of phone numbers for each provider so you can make a quick call now.)

So why are most existing plans so dang expensive? There are three main reasons:

- Brokers Win: The industry often puts its own compensation first. Brokers, the boots on the ground who sell the plans, get very hefty fees extracted each and every year. They might be great guys or gals (most are), but make no mistake, they get paid first.

- The Funds in the Plan: The funds in most plans are there by design because they are willing to share their revenue with the provider. This “pay to play” scenario means you often find expensive funds in your plan that are willing to fork over big commissions, not low-cost index funds that have been shown to easily outperform the expensive “actively managed” funds found in most plans.

- Small Plans Pay More: Today’s providers charge small and midsize businesses substantially more than mega plans with Fortune 500 companies. They are often told they don’t qualify for lower-cost funds or a plan without substantial commissions being paid.

Today’s Alternative

Some would say that the 401(k) is broken. That’s simply not true. Don’t mistake the suitcase for the contents. The 401(k) is just a receptacle, and what goes inside (low-cost funds versus expensive actively managed funds) and how fees are extracted will ultimately distinguish between a 401(k) that’s running smoothly and one that is trudging through mud.

Now for the good news. There are a handful of providers that are on the forefront of a “Netflix” moment in 401(k) plans. One where brokers are eliminated, the funds are low-cost and don’t “pay to play,” local administrators are deemed obsolete thanks to technology, and where instead of educational sessions with stale donuts in your lunch room, participants have personalized advice and on-demand video education delivered to their phone or tablet 24/7.

So how do you discover if you’re paying excessive or hidden fees? Uncovering your true fees can be a daunting task due to the many layers of fees and money changing hands between parties. Our firm will do this financial archeology with no charge (uncovermyfees.com) and give you a benchmark for your files. (Note that a periodic benchmark is required by law.)

If you can shave one annual percentage point off your fees, this means your money could last 10 years longer in retirement. Just as small returns compound over time, high fees do the exact same thing with the reverse effect.

Only 3% of dentists could retire at age 65 without making changes to downsize their lifestyle. It doesn’t have to be this way. Sure, one needs to save as much as possible. But if there is a “hole in your boat,” it won’t matter how disciplined you are.

Mr. Robbins is chief strategy officer of America’s Best 401k. He has had much national media exposure including Fortune, Worth, and Money as well as coverage in local publications including Biz San Diego, San Diego Magazine, and the San Diego Daily Transcript. He also has co-hosted the Wall Street Financial Hour, a Southern California public radio show, and has shared his expertise through platforms such as Fortune Small Business Magazine, National Underwriter, Market Watch, California Broker, and Entrepreneur Magazine’s Radio Show. He can be reached at josh.robbins@americasbest401k.com.

Related Articles

Extract More from Your Retirement Plan

Retirement Reality: Going Beyond “What’s Your Number?”

Choosing Between a Traditional and a Roth 401(k)