Are you comfortably complacent with the way your office bills and collects your hard-earned money? Or worse, have you completely removed yourself from your practice’s financial collection process, totally trusting your employees to tend to your patient and insurance payments and collections? If you answered “yes” to either one of these questions, then get involved now! Arm yourself with the tools you need to manage and monitor your staff’s collection process and empower your staff members with the tools they need to track and collect your money.

When it comes to collecting money, your best friend is computer software. Why? The insurance and even patient collection process is too cumbersome for even the best manual systems. “Deadbeat” insurance companies and patients need to be tracked, billed, and then followed up again and again. Practices that either don’t use software or underutilize their software leave substantial amounts of money on the table. This is money that you have already earned; your office has just failed to collect it.

Many doctors err in making the assumption that dental software is too expensive and too complicated to use. They assume that software will require a computer in every operatory and that, as a clinician, they will be forced to change the way they record clinical notes, capture x-rays, and make patient appointments. These assumptions simply are not true! Don’t get me wrong, I do recommend a completely computerized dental office. And, systems like DENTRIX (Henry Schein), DentiMax (DentiMax), EagleSoft (Patterson Dental), Softdent, and Practiceworks (both Practiceworks) do an outstanding job of providing this kind of solution. However, one computer with the right software will still get the job done when it comes to insurance and patient collections. Fortunately, the market currently offers a few software systems that are easy to use and not very expensive. The single-computer version of DentiMax is one of the systems that I have recommended to friends. It’s fabulous for collections, and there is an easy upgrade path to the complete system, which is key for me.

Whether you currently use software or are buying software for the first time, you need the following specific financial tools to monitor your staff members while at the same time empowering them to collect your money successfully:

- security that includes advanced audit reporting

- insurance aging and patient aging reporting

- daily reports

- insurance claims and patient statements

- easy-to-use payment entry capability.

SOFTWARE SECURITY

When it comes to theft and embezzlement, don’t think that you are immune. According to an April 2007 survey conducted by TheWealthyDentist.com, 59% of all dentists reported that they have discovered evidence of theft in their practices. This kind of finding begs the question, “What about the other 41% of dentists who, shall we say, may be a little more complacent or removed from their office’s billing and collection process?”

About 3 years ago, I became suspicious of an office manager who worked in one of my satellite offices. My collections were way down, and I was concerned. After a quick glance at my software’s appointment book, it appeared that she was un-dercollecting for my associate’s work. I also noticed that the completed procedures for many of the cash patients were not being posted to the ledger. In response, I pulled the progress notes my associate dentist had kept and verified my suspicion: my associate dentist had performed treatments that had not been billed to the patient! I next printed an audit report, which informed me that my office manager was also deleting cash payments and then later re-entering these payments at lower amounts. Hoping that she would voluntarily confess what she was doing, I asked her why she hadn’t billed the “cash” patient for the work that was completed, and why she had deleted cash payments from my software. To my surprise, she gave me a very detailed explanation that addressed my question. I wanted to believe her, but I could not ignore the information my software provided me. So, I called the patient and informed her we were auditing our books; the patient confirmed all of my suspicions.

Obviously, the first line of defense against embezzlement is to hire honest people. But beyond reviewing their work history and calling their references, you cannot guarantee that your staff will never steal from you. To be blunt, without good software you cannot properly protect yourself from employee theft. I would not have caught this office manager without my software program. I shudder to think about the amount of money she could have stolen from me.

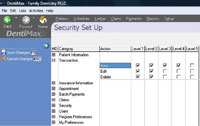

Good software will allow you to set up customized security and then provide you with the reports you need to monitor your staff (Figure 1). This means that you get to define the areas of the software to which your staff members have access and to what degree they get this access. If you don’t want your front desk deleting ledger items without your consent (like cash pay-ments), limit their ledger access rights. You could set it up so your front desk can add and edit but not delete items in the ledger. You also want to be able to print an audit report by your user names. This report will tell you what items your employees have either added or deleted from your software. For example, you could run an audit report by your office manager’s user name to see if any cash payments have been deleted.

During the Cold War, Ronald Reagan quoted an old Russian maxim to Mikhail Gorbachev, “Trust but verify.” Do the best you can in hiring trustworthy employees, but use your software capabilities to verify that they are honest. Routinely verifying that your employees are honest will further increase your trust and appreciation for them. And, in the event you find something, it will allow you to take immediate corrective action before a problem balloons into something larger.

INSURANCE AND PATIENT AGING

A few years ago, one of my friends went through some turnover with his front desk personnel. He hired a new office manager who quickly found my colleague’s accounts receivables for insurance and patients were between double and triple what she had seen in her 2 previous places of employment. Fortunately, my friend’s software provided great aging reports that had the information his new office manager needed to collect his money.

Make sure your front desk employees know how to print and understand insurance and patient aging reports. These reports should age and display outstanding dollar balances in increments of 0 to 30 days, 30 to 60 days, etc, all the way to 120+ days past due. Your insurance aging reports should also display the corresponding patient’s name, date of birth, subscriber ID, group name and number, and other information the insurance companies will request from your staff.

The most important thing your software can provide your office is the ability to collect your money from both insurance companies and patients. And, when it comes to collecting, your front desk personnel need comprehensive and accurate aging reports to do their job.

DAILY REPORTS

|

| Figure 1. Good software will allow you to set up customized security. |

You’ve just finished working a long day and are exhausted. You know all the clinical details on the work you’ve completed in the back office (several crown preps, a first molar root canal, etc), but do you know the exact dollar amounts associated with this work and if the money is being collected? Well, here’s a way to quickly bring yourself up to speed. At the end of each day, briefly review a few key reports. I’m not encouraging you to spend significant amounts of time scouring over every detail of your financials, but I am recommending that you keep a finger on the financial pulse of your practice. You’ll want to scan the Day Sheet, as well as your payment and production reports.

|

|

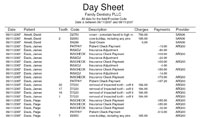

| Figures 2a and 2b. The Day Sheet report displays details of your charges as well as the totals for the current day. |

Most software programs include a Day Sheet report that displays the daily details of your charges and your receipts, as well as the “totals” for that current day (Figures 2a and 2b). Maybe you have a concern about today’s completed procedures being charged out, or you are concerned about whether you received a payment from a certain patient. Maybe you are simply wondering what today’s totals were for patient and insurance payments. Your Day Sheet should provide answers to these and other daily questions in a simple and easy-to-understand format.

Like the Day Sheet, you should review the payment and production reports on a daily basis. These reports provide very specific information on your practice’s performance. The production report will display the dollars associated with the work that you, your hygienist, and any associate dentists have completed. And the payment report will display the actual dollars collected from patients and insurance companies for this completed work. Most production and payment reports let you limit their information to whatever ranges you specify. So, if you are wondering how much money was collected last month for work completed by your hygienist, simply plug in the right ranges, and your payment report will display how much money was collected from insurance payments, credit card payments, etc.

|

|

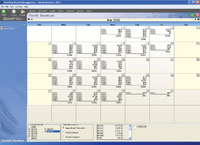

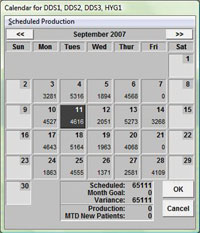

| Figures 3a and 3b. Dentrix and DentiMax provide a great visual summary for the production report. |

For those of us who are visually oriented and don’t particularly enjoy reading through reports, some software programs provide a great visual substitution for the payment and production reports. Dentrix provides a Scheduled Production screen, which displays your practice’s production dollars by day. DentiMax’s appointment book takes this idea several steps further by graphically displaying the dollars for your practice’s payments, scheduled production, and completed work, all on a monthly calendar (Figures 3a and 3b). I have a friend who has confessed that he is addicted to viewing this graphical revenue screen. And I can understand why—at a glance you can easily view the answers to many of your pressing financial concerns. For example, you can graphically view how much money you really collected for work your hygienist produced, what kind of dollars you’ll make for the appointments scheduled for next month, and what you will eventually be paid for today’s completed work, as well as answers to other financial questions.

INSURANCE CLAIMS AND PATIENT STATEMENTS

EASY-TO-USE PAYMENT ENTRY CAPABILITY

|

|

| Figure 4. Your software should provide an easy way for your staff to capture the various details of an insurance payment. | Figure 5. Your software will need the ability to divide and apply the patient payment easily. |

The primary purpose of your dental software is to enable your practice to bill patients and insurance companies efficiently and to ultimately receive their payments—that’s why it was created. Your software’s crowning moment is when a payment is made and your staff enters a dollar amount to your patient’s ledger. Make sure that your software does not fall short in this most important area. Your staff’s ability to enter patient and insurance payments easily and display this information is of utmost importance to your practice. If your front desk incorrectly enters payments, all of your financial reports will be wrong. And, from a financial standpoint, your practice will be lost.

Your software should provide an easy way for your staff to capture the various details of an insurance payment (Figure 4). In-surance checks are usually accompanied by an explanation of benefits (EOB) statement from the insurance company. This document provides instructions on how to apply the insurance check payment to its corresponding patients and their procedures. The EOB also indicates whether there were deductibles on certain patient procedures and, in the case of a preferred provider office (PPO), what dollar amounts need to be written off. You want to capture all of this financial information so your software can reflect the correct amounts your patients owe, determine whether the deductible has been met, and correctly age your patient and insurance outstanding balances for all of those aging reports.

Patient payments are usually easier to record than insurance payments; however, there are scenarios where recording a patient payment can be a bit complicated. It is common for a patient to write a check that is applied not only to his or her own appointment and outstanding balance, but is also applied to family members’ outstanding balances. In cases like this, your software needs the ability to divide and apply the patient payment easily among the various family members’ ledgers (Figure 5). The way you compensate your providers may also complicate the process of entering payments. If your hygienist and/or associate dentist pay is based on his or her collections, your software needs to be able to break up the patient and insurance payments—eg, a patient payment for an exam would be assigned to the doctor, but the prophy portion of the payment would be assigned to the hygienist. This way your payment and other financial reports will accurately reflect the associated dollars for the work completed by your providers.

CONCLUSION

Dr. Stapley practices general dentistry in Mesa, Ariz. He currently owns and practices out of one dental office, but at one time he owned 4 practices. His practices have used various software programs, including Softdent, DENTRIX, and DentiMax. He can be reached at (480) 830-8946 or stapley@cox.net.